Cambridge has considerable strengths in research, discovery and innovation in the advanced materials sector and acts as a national discovery engine.

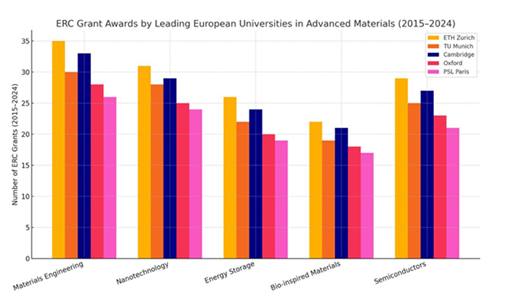

Cambridge is in the European Top 3 for ERC-funded materials research and has 135+ spin-outs / scale-ups in materials.

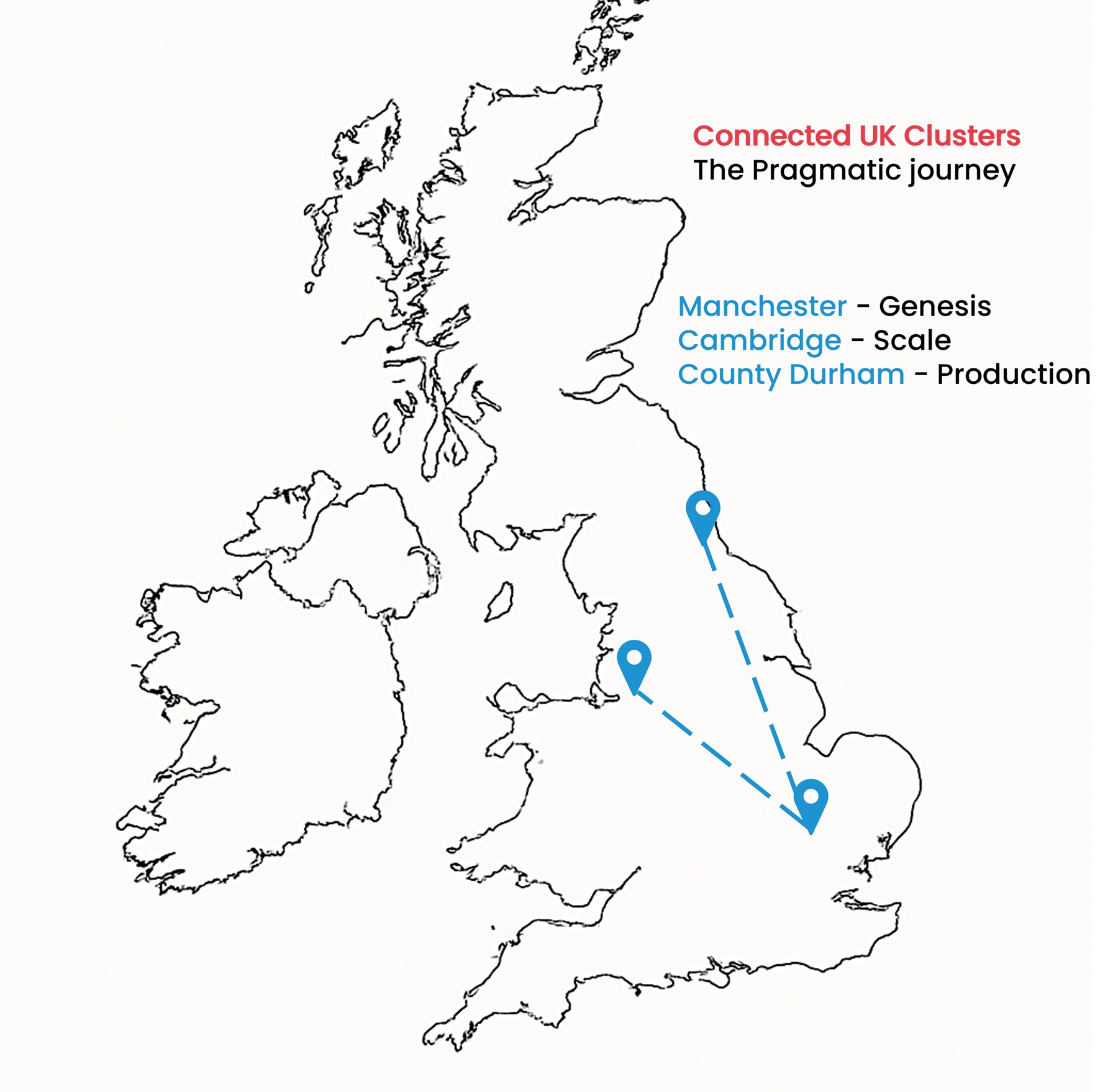

There are significant connected relationships between Cambridge and other UK centres of excellence, including Manchester, South Wales, Glasgow/Strathclyde and the North East. More high-value cluster relationships could be developed with concerted Government and industry effort – UK founded firms are often notably committed to scaling within and across the UK as Growing Together Alliance Connected Clusters research has drawn out.

Commercialising these innovations is challenging, particularly in Cambridge. This is an opportunity for the Cambridge region and other regions in the UK to develop mutually beneficial cluster connections – with Government backing. Challenges include:

- Advanced materials are not properly understood or recognised as a “platform technology” that underpins and enables the achievement of other sectorally-specific objectives such as net zero, quantum, defence and digital outcomes – advanced materials as a sector is not adequately recognised in the Industrial Strategy

- Manufacturing associated with advanced materials is resource intensive and sometimes involves hazardous materials – meaning the facilities are not easily / cost-effectively delivered

- It is rare to find the mix of skills necessary to progress from research & prototype to pilot and manufacture in one place. Cambridge has tremendous strengths in the former, but is short of the latter. Other places around the country have different talent pools and facilities, but are not adequately connected at present – either in terms of transport infrastructure or sector strategy.

- Patient investment capital to enable companies to scale is not as readily available as desired – particularly linked to the cost of prototyping / demonstrating products.

To overcome these constraints and capitalise effectively on Cambridge’s research and innovation strengths, a dedicated strategic approach is required. This should incorporate:

Strategic direction setting and streamlining from Government

- Government should take a mission-led approach which will enable those in industry to better map business plans to UK ambitions – for example, reducing the power demand of datacentres could be a grand challenge that enables those in advanced materials to see their role and route to impact and exploring novel sustainable approaches.

- A coherent Government position and identified cross-Government lead on advanced materials as a sector in their own right, that is essential to enable delivery of other downstream outcomes.

- There may be opportunities for the UK to become quicker at qualifying, for instance, through the use of AI and deep tech.

Supporting routes to prototyping and scaling of ADVANCED manufacturing in the UK

- The different strengths of different clusters around the UK need to be better understood and articulated to help start-up businesses see where best to scale. The clusters need to be better connected places, through infrastructure and through a coherent, complementary strategy. The devolved administrations and Metro Mayors have a key role to play. For this sector at least, it would make sense to treat the UK as a whole as a cluster that, together, can compete on the global stage “from lab to fab”.

- A talent pipeline across the whole life journey of innovation to production needs to be developed, to avoid businesses having to buy-in talent from overseas, with all the costs of visas and other human and bureaucratic complications of that.

- Reforms in the investment community are essential to unlock patient capital to support scale up of innovative ideas in this and other knowledge-intensive sectors. Similarly, the UK Government needs to become more pro-active and nimble, to avoid businesses having to look overseas (including to foreign governments) for investments that may pose potential national security questions.

- Capital expensing does not currently benefit many of the UK’s most exciting technology companies, such as start-ups and scale-ups that are investing heavily in high-value manufacturing. HMRC could offer a tax credit, available as a cash credit (like R&D tax credits), for qualifying investment in equipment and property, focused on the five critical technologies. This would dramatically improve the attractiveness and competitiveness of targeted advanced manufacturing in the UK.

- The physical requirements for manufacturing facilities need to be well-understood, and the constraints / opportunities in particular locations need to be made clear (not least by actors in the planning process), to help businesses know where this is a viable proposition to scale their idea. Interventions – such as those emerging in Local Growth Plans – need to be targeted to addressed the specific local barriers, both physical and human (talent pipeline).

Further strengthening of connections between clusters

- Partnerships between industry, universities and authorities can help unlock growth opportunities [example from Pragmatic of multi-stage prosperity partnership with Bath, Liverpool & Cambridge]

Pragmatic Semiconductor, founded in 2010 in Cambridge, UK, sustainably manufactures ultra-thin, flexible chips (FlexICs) using advanced materials and thin-film transistor (TFT) technology. These low-cost, low-carbon semiconductors can be embedded into everyday objects, enabling item-level intelligence across consumer, industrial and healthcare sectors. A Cambridge-incubated concept, Pragmatic established manufacturing in County Durham with its first production line in 2013. Early investment rounds totalled over £300 million, including a landmark £182 million Series D raise in 2023, the largest ever for a European semiconductor company. This enabled the organisation to scale by opening Pragmatic Park in 2024, home to the UK’s first 300mm flexible wafer fab. In 2025, Pragmatic launched its Gen 3 FlexIC platform and NFC Connect 1301 product targeting smart packaging and IoT markets. Now employing 350 people, Pragmatic is on track to become the UK’s largest semiconductor manufacturer by wafer volume by the end of 2025.

Critical enabling factors to Pragmatic’s growth journey

During the early stages Pragmatic’s development depended on flexible funding schemes and partnerships with universities, RTOs and industry. The nucleus of Pragmatic originated when founders White and Price collaborated on a business in Manchester. The existence of an IKC (Integrated Knowledge Centre) in Cambridge enabled the realisation of a “spin-in” arrangement, accessing facilities and collaborating closely with Engineering, Physics and Materials. In addition to InnovateUK funding supporting early R&D, schemes such as AMSCI (Advanced Manufacturing Supply Chain Initiative) enabled investment in new capital equipment at the Centre for Process Innovation, supporting a transition from lab to pilot-scale, derisking the move to manufacturing.

The advent of the Local Growth Plan and subsequent sector plans, a Strategic Spatial Strategy, Ox-Cam SuperCluster and connected clusters (e.g. Cambridge x Manchester) present opportunities for more co-ordinated and strategic action and leadership in this space from the CPCA, Cambridge Ahead, businesses and other stakeholders.